Where will the pound be by Christmas? While no-one can predict with any certainty how any currency pair will trade in the future – not without a crystal ball – that doesn’t stop the major banks from having a go. There is something to be said for the wisdom of crowds, too, and this takes an average of those forecasts. We also look at the economic and political factors to look out for in the UK, Europe and US over the next three months.

Even so, at Smart we strongly recommend a strategy of focusing on your own plans, setting out your required budget and then fixing your rate with a forward contract.

What’s affecting currencies now?

The period from June to September was eventful. The new Prime Minister, elected by the Conservative party membership, applied what he perceived to be his Brexit mandate with full force, proroguing Parliament, suspending his own rebellious MPs and drawing up plans for a revised Brexit deal.

In the process Boris Johnson lost a record number of votes in Parliament, lost his working majority in the House of Commons and was deemed to have illegally suspended Parliament. Yet, it is apparent that Johnson still intends to take the UK out of the EU by the 31st of October. It is unclear how he will do this, and considering the potential barriers that are in his way, it’s not set to be an easy task.

Political uncertainty has been mirrored in the pound. Any moves towards a Brexit deal have boosted sterling but optimism for a deal comes and goes, taking the pound with it. shrank. We will undoubtedly see further volatility for sterling.

Europe has had its fair share of woes too. Both Brexit fears and global trade tensions have exacerbating its weakening economy. Germany, usually the economic powerhouse of Europe, has been dealing with a slump, with France and Italy also trailing behind. Christine Lagarde inherits a huge task as she takes over from Mario Draghi as President of the European Central Bank. A run of resignations by ECB board members due to disagreements over policy will not have helped.

In the rest of the world the US-China trade war drags on, and the US economy has been showing signs of a gradual slowdown. The Federal Reserve cut interest rates twice last quarter to support the economy, and could even make a third cut this quarter if economic data continues to fall short of expectations. This marked a shift from its previous ‘cautious’ strategy. However, it continues to be hounded by President Trump, who wants the Fed to cut rates aggressively.

Where next for the pound?

The biggest factor will of course be Brexit. The Irish backstop remains the sticking point in Brexit negotiations. Boris Johnson’s alternative plans for the Irish border would keep Northern Ireland in the single market for goods while also keeping it in the UK customs territory. This means that there would have to be checks on goods, which Johnson has said would take place away from the border. The Irish Deputy Prime Minister has stressed that this is not purely a political and economic topic, but also an emotive one.

Within the last quarter, the Prime Minister has lost his majority in the House of Commons, meaning that the government are keen for an early general election to take advantage of what they perceive as the weakness of Jeremy Corbyn’s appeal. That didn’t work out brilliantly for Theresa May in 2017, and the financial markets will be wary of a potential hard-left Labour government.

On the other hand, the argument appears to now be a question of whether we get a second referendum before a general election, or vice versa, and the markets appear to like the idea of another referendum.

The government’s Yellowhammer Report, outlining possible implications of a no-deal Brexit, provides a bleak assessment of how the economy could fare if we left without a deal. The UK’s consumer demand has so far cushioned the economic impact of Brexit, however, it’s uncertain as to whether this will continue.

Poor economic data and dovish statements from the Bank of England have suggested that interest rates could be cut in the near future – which tends to weaken the pound. Manufacturing, construction and services figures are now all in contraction territory, raising fears of a recession. Services PMI unexpectedly shrunk in September, reaching a 6-month low as the worst September reading among advanced economies.

Where next for the Euro?

The main factor affecting the Euro is the economy, which is vulnerable to US-China trade tensions and the threat of a no-deal Brexit. It is already suffering these, even as it awaits $7.5 billion of US tariffs on EU imports which the World Trade Organisation has approved due to a long-running dispute over the illegal subsidies given to Airbus. Tit-for-tat tariffs could have a significant effect on both the European and American economies.

The European Commission first woman, Ursula von der Leyen, who will replace Jean-Claude Juncker on the 1st of November. A somewhat controversial choice initially, she is expected to table new minimum wage protections, pay-transparency measures and a new strategy on the ethics of artificial intelligence. She has also called for more ‘growth-friendly’ fiscal policies in the Eurozone.

Where next for the US dollar?

It’s widely expected that the US-China trade war will continue to take its toll on the global economy, and especially on the American economy, where recent ISM manufacturing figures came in at a 10 year low. The International Monetary Fund says that tariffs could reduce global GDP by 0.8% by next year, and in the meantime we’re at a stand-off. US demands would require structural change in China, which Chinese officials are so far unwilling to make.

President Trump continues to blame the Federal Reserve for not cutting interest rates fast enough. The Fed chairman Jerome Powell argues that overall America is doing well enough to avoid a further stimulus, after cutting interest rates twice in the last quarter. After the poor manufacturing and non-manufacturing figures, however, expectations for another cut have grown.

President Trump is also facing criticism over his removal of US support for the Kurds and for his efforts to have Ukraine investigate frontrunner for the Democrat Presidential candidacy, Joe Biden. With the US presidential election just a year away, such matters could influence the decisions of the electorate and, by extension, the fate of the US dollar.

The forecasts

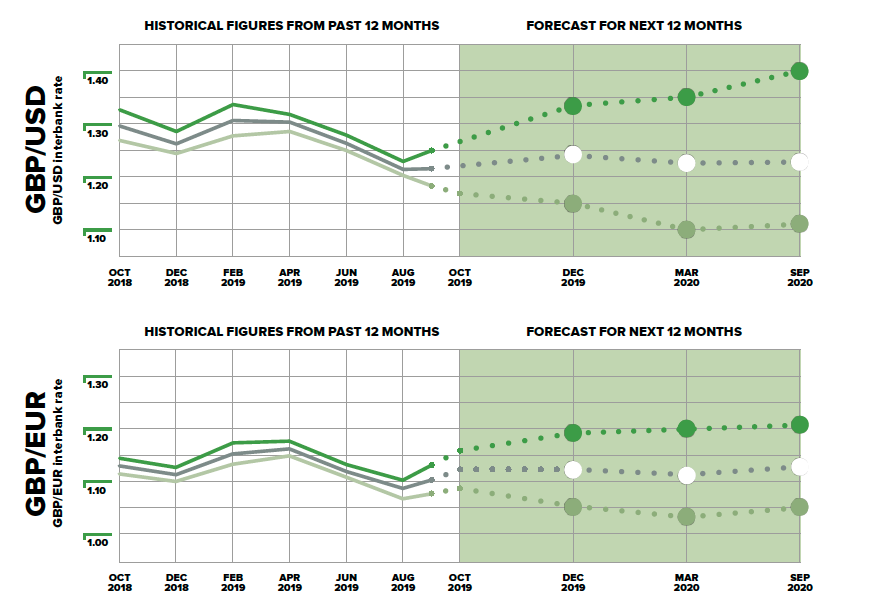

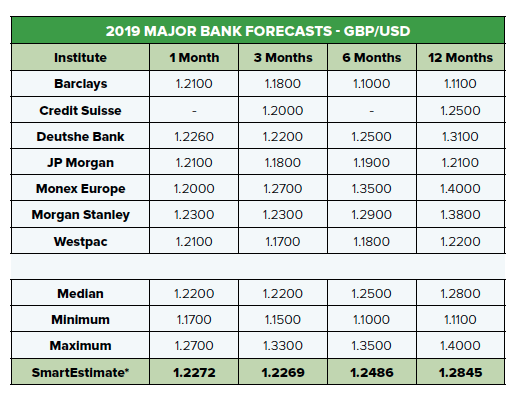

Taken overall, we see a very wide margin even just over the period to Christmas, with the potential for the highest rate against the US dollar since the Referendum, or even sinking below the 34-year-low that we saw during the summer.

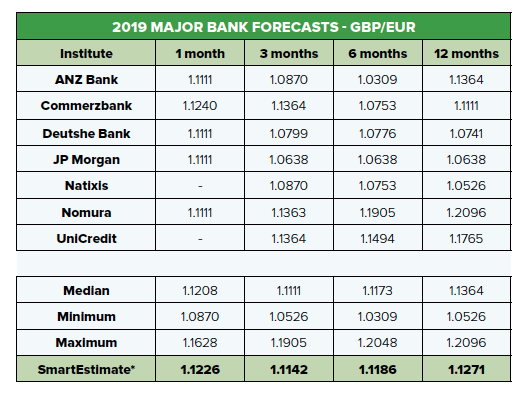

Against the Euro, again, the predictions are for huge volatility. The higher estimates would be a return by Christmas to the level of spring 2019 when the markets were boosted by the failure to leave the EU on 29th March. The lows would take us to near parity against the Euro, although not significantly lower than we saw when Boris Johnson became PM.

The longer-term predictions essentially divide into a no-deal scenario that is as bad as some predict, or one where the UK economy survives reasonably intact.