Our brand-new quarterly forecast comes at a nervy and excitable time in the currency markets. See what the ‘experts’ predict the pound will be worth against the euro and dollar by Christmas and into 2023.

The mini-Budget upset the markets, inflation is at record levels, the war in Ukraine is ever more dangerous and there’s a threat of power cuts this winter. Meanwhile, a hawkish Federal Reserve is risking global recession in its battle to control inflation, with the Bank of England following behind. However it’s not all bad news as the pandemic looks to be over and unemployment is the lowest for decades and tax cuts are coming.

In short, economic uncertainty is widespread, and this is reflected in the currency markets.

Get a quote from us today by completing our simple form. We’ll take a look at your requirements and arrange to speak to you at a suitable time to offer the best possible solution for all of your upcoming currency transfers.

For our readers who will be making a sizeable transactions overseas in the year ahead and who, therefore, could be paying thousands more or less (depending on the strength of the pound) we strongly suggest you do not base any financial decision solely on the predictions from major banks.

However, whilst their predictions may only be educated guesswork, they build into a fascinating guide to the political, economic and health events that will influence the pound and other currencies.

The brand-new Quarterly Forecast is free to download and packed full of analysis and insight from our currency experts here at Smart.

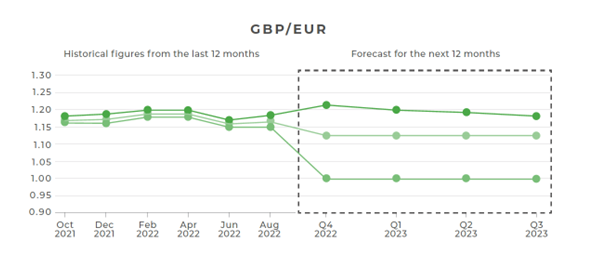

Pound versus euro

According to some analysts, GBP/EUR could fall to around €1.00 in the next three months. Not everyone is quite so pessimistic, though, as predictions stretch as high as €1.20.

The pound was choppy against the euro this week following the aftermath of the Chancellor’s mini-budget and the Bank of England’s deadline on its bond-buying scheme. However the GBP/EUR shot up by almost 1.5% on Thursday after lunch, following government discussions to scrap the mini-budget completely.

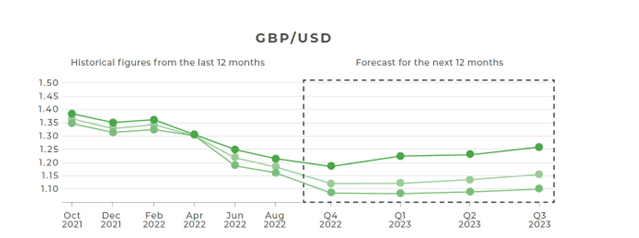

Pound versus dollar

The dollar sailed past parity with the euro and pushed the pound to its weakest since 1971. The prompt has been a risk off mood among investors, with the threats from Russia, compounded by the hawkish stance taken by the US Federal Reserve, with three successive interest rate rises of 75 basis points, and probably a fourth in November, to a rate mid-next ear of around 4.5%.

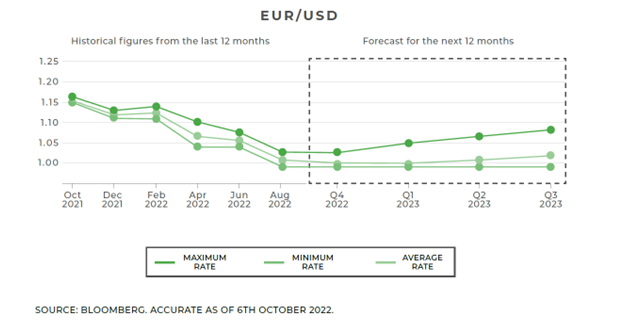

Euro versus dollar

Predictions also show a large disparity for EUR/USD, ranging between 0.99 and 1.15 over the next three months.

The euro has continued to struggle against the dollar and hovers below parity. The energy crisis and developments in the ongoing war in Ukraine is a major contributor to this, holding the euro down as the US dollar is seen as the ultimate safe-haven asset in a risk off environment.