To say the start of 2019 has been a rollercoaster ride would be an understatement. We’ve had Brexit that didn’t happen – and then didn’t happen again – and hints of a US-EU trade war. But the British still make up the biggest group of overseas buyers in many European countries. The reason’s simple: they’re planning ahead, working out a currency strategy. And so can you. Find out in today’s blog what the forecasts say for the next three months, and what you need to do to make your overseas dream a reality.

What has happened over the last quarter?

Despite the fact that Brexit developments have ramped up a gear, uncertainty has been rife over the last few months. This has had a knock-on effect on sterling, which has been volatile to say the least against both the pound and the euro. Speculation of a delay to Article 50 caused sterling to strengthen, whilst the increased possibility of a no-deal impacted the pound negatively. When a medium delay was eventually agreed, sterling offered a mixed reaction. The only certainty is that the pound has been truly impossible to predict.

The Eurozone’s growth outlook was cut for a fifth consecutive month on the back of a disappointing 2018 and ongoing woes in the manufacturing sector. European data as a whole continued to show all countries, but most worryingly Germany, suffering from a sharp slowdown in growth. The big worry for Mario Draghi and the other ECB members is that, in the event of the slowdown turning into a deep recession, there is little they can do to support the economy – with interest rates already at zero, further cuts are unthinkable. Gathering clouds over a possible US-EU trade war do not help the outlook.

What will be the main influences on the markets?

There’s a lot on the horizon, both politically and economically. Cross-party Brexit talks still need to produce something that can command a majority across the House of Commons – and the EU has made it clear that the Withdrawal Agreement is not to be renegotiated. Growth in the UK was higher than expected in February, but business activity very much stalled in March and we saw the weakest performance in the private sector for almost seven years.

The Brexit extension until 31st October isn’t guaranteed to smooth things out, either. Theresa May has the task now of ensuring that the sense of urgency, and momentum, that existed until the 12th April isn’t lost. If it is, then we could find ourselves in the same situation in October as in April and March.

What does this mean for the pound and euro?

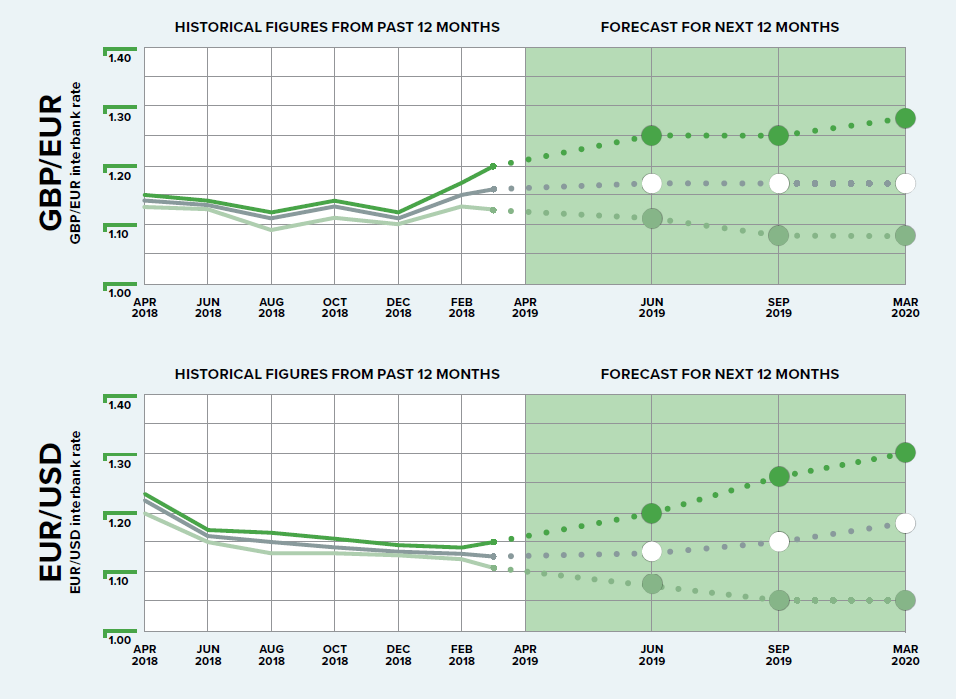

We’ve gathered together the major predictions for the pound against the euro and, if there’s just one thing we can take away from them, it’s that nobody really knows.

Yes, you read that correctly. There is a two-point difference between where the pound is expected to be in twelve months’ time. That’s the difference between £200,000 getting you €256,420 or just €217,000.

We’ve gathered together the major predictions for the pound against the euro and, if there’s just one thing we can take away from them, it’s that nobody really knows.

So if no-one knows where the pound will be – to the extent that they’d predict your budget to differ by as much as €30,000 for £200,000 – then what can property buyers do?

How can you protect your money?

The answer is surprisingly simple. Don’t make playing the markets your currency strategy. Inevitably, it won’t turn out as you expect (not even the world’s major banks can second-guess!). Instead, do as thousands of property buyers do – almost 70% in our recent survey of those purchasing in Spain – and protect your money with a forward contract. A forward contract means that you agree to purchase a set amount in the future at today’s rate. In other words, you can fix the same exchange rate for the next twelve months, at no extra fees, and then sit back and completely ignore the news for the next year!

A forward contract means that you agree to purchase a set amount in the future at today’s rate. In other words, you can fix the same exchange rate for the next twelve months, at no extra fees, and then sit back and completely ignore the news for the next year!

It also means that you have a fixed budget. You know exactly how much your, say, £200,000 will get you in euros and you can negotiate accordingly. With the Easter holidays coming to an end, many of you will have been or will soon be planning a viewing trip, and securing a fixed rate before heading out means you can make an offer immediately. No going home to talk to your bank and then to your currency broker, only to find that someone else has offered in the meanwhile.

Find out more about a forward contract by making an enquiry, or calling your Personal Trader on 020 7898 0541 today.