The pound currently stands at around 3% above its average for 2019 against the euro. However, having been spoiled by its stratospheric but brief rise in the hours after the general election result, many of us may be hoping for more. Is that a realistic option? In our quarterly forecast we sift the evidence and examine what other leading financial institutions are predicting.

This time last year, we were expecting to leave the EU by the end of March. Little did we know what the next 12 months had in store for us! Not only was Brexit delayed three times, we also had a new prime minister and the first December general election since 1923. Donald Trump was impeached, a preliminary trade deal was agreed and Europe re-introduced quantitative easing.

You might think that with ‘no deal’ averted, the US-China trade war cooling and the long-predicted global recession not materialising, that we can all relax. Maybe not just yet though. With two Brexit deadlines approaching, Europe’s economy faltering and the upcoming Presidential election, this quarter and the year ahead could bring more political and economic uncertainty.

What will affect the pound and Euro?

From the UK’s side of the equation, leaving on 31st of January doesn’t mark the end of the Brexit process. The general election was swiftly followed by an announcement that the government would seek a hard deadline to the Brexit transition period at the end of 2020, bringing back the chance of a no-deal Brexit and causing the pound to drop to pre-election lows.

This possibility could bring further volatility for the pound, especially since EU officials have warned that it could be difficult to negotiate a trade deal in just a year. Brussels says that if a trade deal is agreed before the deadline, it will be a basic one due to the short timescale.

Any news or developments on the progress of trade talks over the next year could spell volatility for the pound. As we approach the end of 2020, we could see this volatility heighten, especially if talks run right down to the wire.

On the Eurozone’s side, with Germany narrowly avoiding a recession, last year wasn’t a great one for the Eurozone’s economy. Economic decline has slowed slightly. However, recent data still looks mixed at best. GDP stayed the same at 0.2% for the last three months of 2019, whilst the Eurozone reported its largest trade surplus in over two and a half years. Despite this, Manufacturing PMI was poor across the board and remained in contraction territory for the Eurozone, whilst retail sales also decreased.

There are hopes that easing trade tensions between the US and China could have a positive effect on the Eurozone economy in 2020. However, signs of tensions resurfacing between the EU and the US may spell trouble. In addition to the Airbus dispute when the US won the right to impose tariffs against the EU, France issued a digital tax at the end of last year which angered Washington. President Trump said that it unfairly targeted US tech companies and threatened to introduce tariffs on French imports. France warned the US of strong EU retaliation if necessary.

Brexit may also continue to pose a threat to the European economy throughout 2020. ECB official, Robert Holzmann, said that interest rates would not be hiked this year and cited Brexit as a chief concern economically.

What will affect the pound and US dollar?

After cutting interest rates three times last year, the Federal Reserve remarked that the US economy is in good shape. Fed officials voted unanimously to keep rates on hold in the last monetary policy meeting of the year and signalled that a significant change in outlook would be required to either cut or raise rates.

The outlook for this year remains modestly positive, with GDP for the final quarter of last year growing by an annualised 2.1%, following a 2% expansion in the previous three month period. However, whilst the latest FOMC meeting minutes reflected that monetary policy is likely to remain appropriate “for a time”, they also cited downside risks such as “persistent uncertainty regarding international trade and weakness in economic growth abroad”.

Goldman Sachs carried out a report with positive findings, suggesting that the US economy is nearly recession-proof. It found that the low levels of volatility marked by sustainable growth and muted inflation are still standing. However, as the FOMC minutes suggested, the US-China trade war, tensions in the Middle East and global economic weakness could still pose risks.

Forecasts

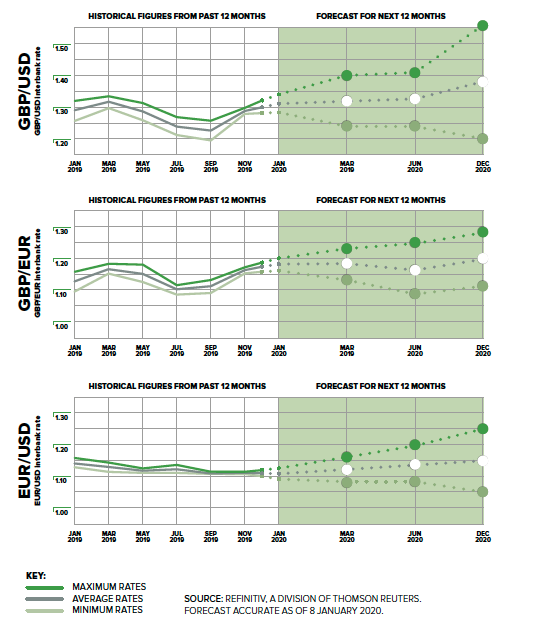

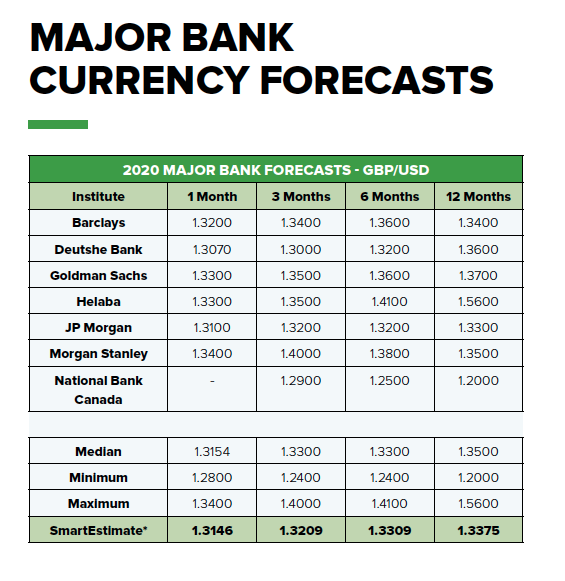

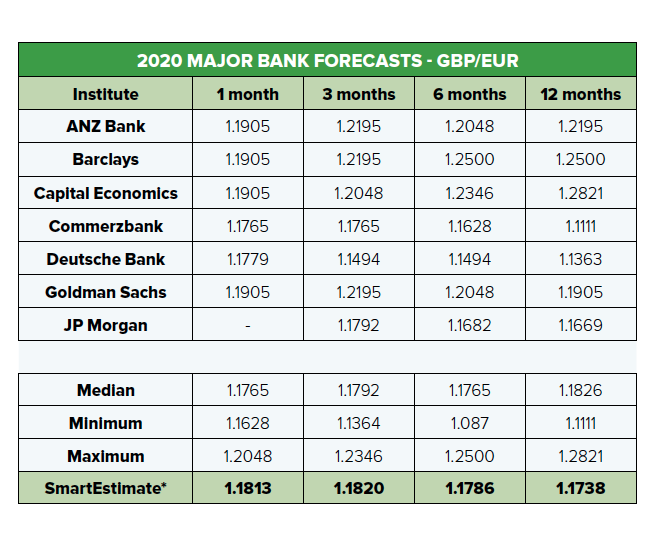

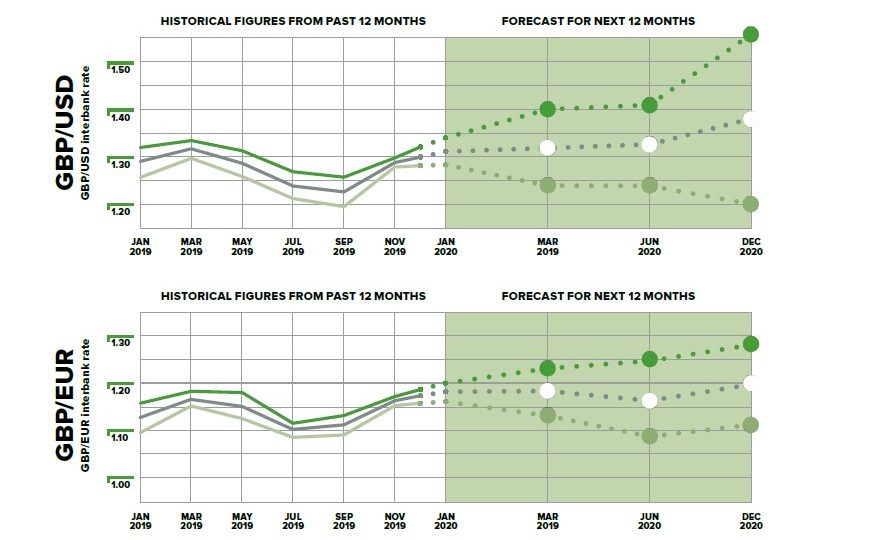

And so to the forecasts themselves. We took a selection of forecasts as of 9 January 2020 to show the extremes, but with the average across the whole range.

You can download the full report here.