When the global economy is in freefall, you may wonder why the pound has – after initial jitters – recovered to its average for the past three years. And where will it go by summer and the lockdown end?

If you read the business press these days you’ll see fresh calamities being reported every day. The fastest rise in jobless claims, the fastest fall in monthly GDP, the price of oil at below zero, great companies teetering on the edge of going bust, the pubs potentially closed until Christmas…!

The story with currencies has been less dramatic and in many ways it’s been business as usual. After the initial collapse in the pound to a 35-year low against the USD and 11-year low against EUR, we’ve seen a recovery to a level slightly above the average since the Brexit vote.

Few currency market analysts really thinks this will last. However, the picture is so complicated, so in our Quarterly Forecasts we gather the predictions of all the major banking and financial institutions and show both the outliers and the average. This month the ranges are wider than ever.

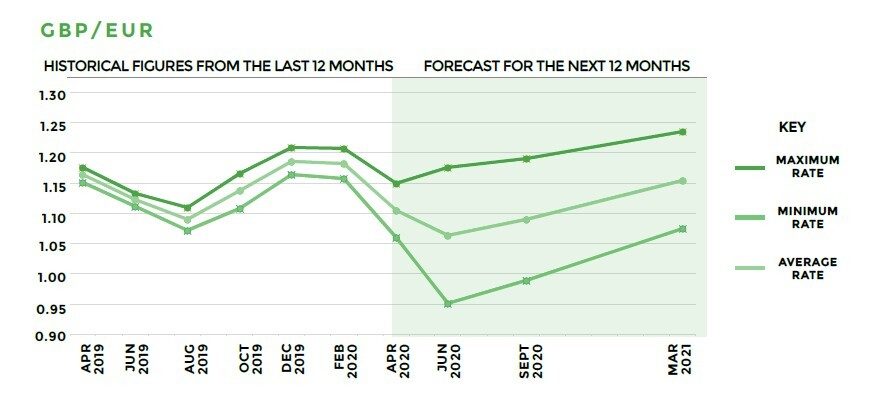

Pound versus Euro

According to some analysts, GBP/EUR could reach its lowest level ever in the next three months to around €0.95. Not everyone is quite so pessimistic, however, with the average high stretching as high as €1.17 but settling at an average of €1.11.

Although almost the entire eurozone is in lockdown and has been for weeks, thanks to its low interest rates it is a “funding currency”. These means buy it as they sell other assets. That kept it strong against sterling in the early days of the crisis.

In recent years the pound has tended to take a dive just as we’re about to go on holiday – no you didn’t just imagine that! – and the forecast is for the same this summer. By September, however, most analysts see it returning to current levels or as high as the post election boost last December. There are longer-term risks for the eurozone if it leads to more fracturing and disagreement between richer and poorer states.

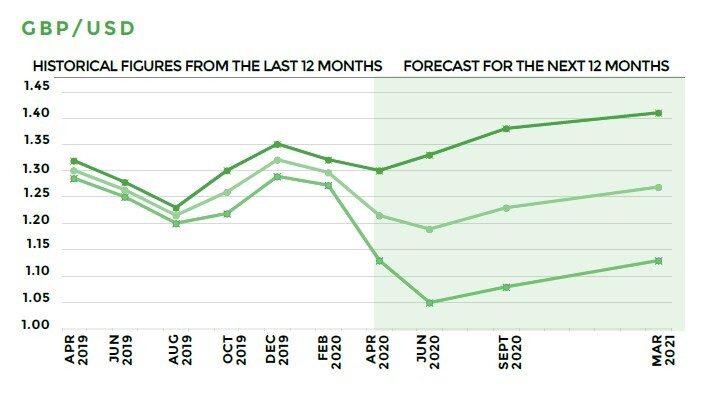

Pound versus US dollar

The most optimistic predictions by July is a recovery to above pre-crisis levels of $1.33. While the majority of leading banks had sterling trading in the mid-$1.20s, some institutions are far more pessimistic, at $1.05.

Although almost all foresee a recovery in the autumn and going into 2021, the most optimistic forecasts are for just tipping $1.38 by the autumn, far below pre-Referendum levels. In the autumn we run into other factors, most notably the US Presidential election and Brexit.

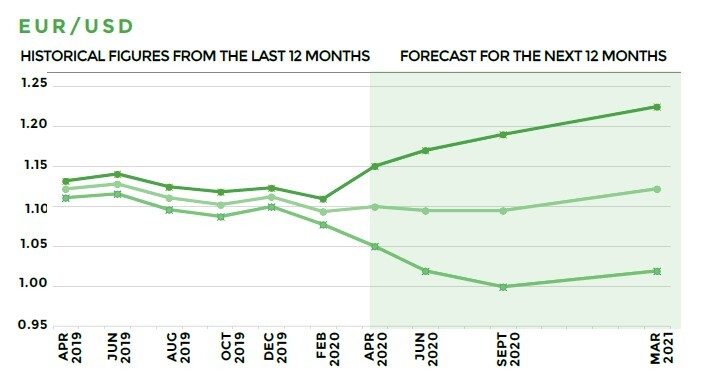

Euro versus US dollar

The first days of the crisis saw sharp movements in the EUR/USD. The euro strengthened by 6% over two weeks, then fell by even more before settling at around $1.08, its lowest level for three years. The average forecast is for it to stay trading at this level over the summer before recovering to above $1.10 by next spring.

At the extremes, however, whereas our other pairs show a narrowing gap by autumn and then year-end, EUR/USD gets wider. The spread is anything from parity to $1.20 by September, although all the predictions are for the euro to strengthen in 2021.