With the global supply shortage, Omicron variant, Brexit fall-out and more, the economy faces a ‘perfect storm’ this quarter. But what does this mean for currency?

For anyone making a significant transaction overseas in the year ahead, the headwinds facing British business (and the general public) could continue to send sterling in a downward direction. Whether you’re a property buyer overseas, thinking of retiring to the sun, or have business interests in another currency, any loss to sterling could hit you in the pocket too.

In our Quarterly Forecast, free to download we analyse what will be shifting exchange rates over the next quarter and year ahead. Along with currency and economic insight from the experts at Smart, it includes predictions for GBP/EUR, GBP/USD and EUR/USD for the year ahead, from some of the leading global bankers.

Download the full Quarterly Forecast here, or read edited highlights below.

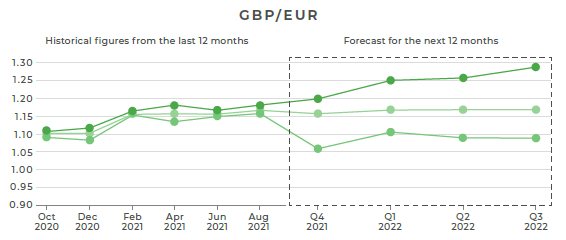

Pound versus euro

According to some analysts, GBP/EUR could fall to around €1.06 in the next three months. Not everyone is quite so pessimistic, though. Predictions stretch as high as €1.20 but settle at an average of €1.16.

At the moment, the pound is taking queues from the Bank of England and anything that may influence BoE decision making. The Bank is due to hold its November monetary policy meeting next week and, due to recent comments from officials, the markets are expecting an interest rate hike. The pound has strengthened due to this and could appreciate further if a hike takes place. However, if messaging from the Bank is more ‘dovish’ or cautious than expected, then sterling could weaken.

As we head into winter, COVID-19 could re-emerge as an influential factor for the pound. Cases are rising and if the government’s winter ‘plan B’ needs to be implemented, then sterling could weaken.

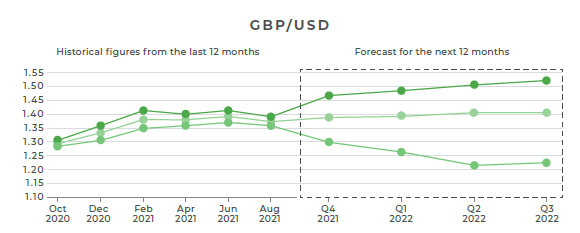

Pound versus dollar

The bank’s predictions show a huge disparity for this pairing over the next 12 months, with forecasts ranging from 1.23 to 1.53!

The dollar is impacted by comments and actions from the Federal Reserve. On the final day before the Fed’s ‘blackout’ period (a period that begins in the lead up to an FOMC meeting, prohibiting officials to speak to the press), Fed Chair, Jerome Powell, said that it is time to start winding down the bond-buying programme. This is due to concerns over rising inflation. However, he added that the Bank would be patient on hiking interest rates.

More will be revealed at the Federal Reserve’s meeting next week. The dollar has weakened slightly in anticipation of this due to worries over slowing economic growth and high inflation.

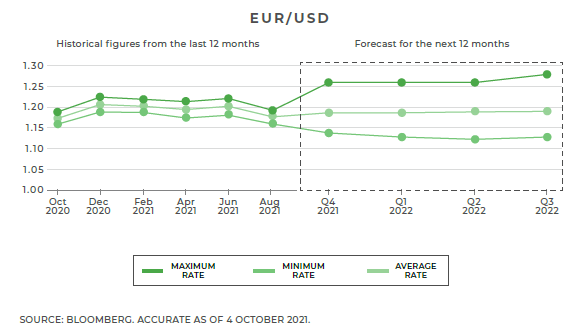

Euro versus dollar

Predictions also show a large disparity for EUR/USD, ranging between 1.14 and 1.26 over the next three months.

Like in the UK and US, the actions of central banks are also likely to affect the euro over the coming months. The European Central Bank has, so far, taken a more ‘dovish’ stance towards monetary policy compared to the Federal Reserve and Bank of England. This means that it is erring on the side of caution when it comes to tapering monetary policy and have confirmed that interest rates will only be hiked in 2024.

Although officials reportedly have mixed views, the official line taken by the Bank is that high inflation is transitory and, although the economic situation has improved, monetary policy is still needed to support the economy. As ECB official, Andrea Enria, said last week, “caution remains of the essence.”

Get a quote from us today by completing our simple form. We’ll take a look at your requirements and arrange to speak to you at a suitable time to offer the best possible solution for all of your upcoming currency transfers.