Like the beginning of last year, 2022 has started on uncertain ground. Central banks across the globe face the quandary of whether to tame unruly inflation or safeguard economic growth – a task made all the more difficult by the pandemic, which continues to impact lives across the globe.

But what does this mean for the currency markets?

Get a quote from us today by completing our simple form. We’ll take a look at your requirements and arrange to speak to you at a suitable time to offer the best possible solution for all of your upcoming currency transfers.

For our readers who will be making a significant transaction overseas in the year ahead and who, therefore, could be paying thousands more or less depending on the strength of sterling, we strongly suggest you do not base any financial decision solely on the predictions from major banks.

However, whilst their predictions may only be educated guesswork, they build into a fascinating guide to the political, economic and, these days, health events that will influence the pound and other currencies.

The brand-new Quarterly Forecast is free to download and packed full of analysis and insight from our currency experts here at Smart.

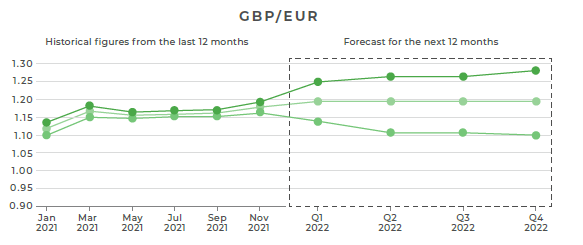

Pound versus euro

According to some analysts, GBP/EUR could fall to around €1.14 in the next three months. Not everyone is quite so pessimistic, though. Predictions stretch as high as €1.25 but settle at an average of €1.19.

Since the beginning of 2022, the pound has been well supported by increasing expectations for an interest rate hike in February. The Bank raised the interest rate in December and several comments from officials, including Governor Andrew Bailey, mean that the markets have now largely priced in another hike in February, which could see the pound strengthen further. However, if these expectations are not met, we could see sterling weaken.

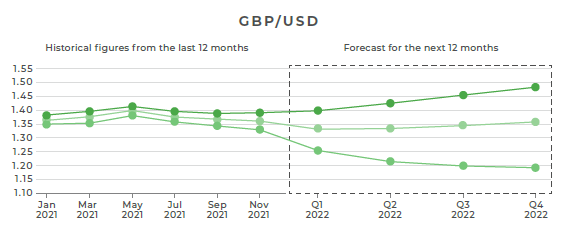

Pound versus dollar

The bank’s predictions show a huge disparity for this pairing over the next 12 months, with forecasts ranging from 1.26 to 1.40!

Like the pound, the dollar is impacted by comments and actions from the Federal Reserve and there are increasing expectations of an interest rate hike in March. This is supportive of the dollar, as is the recent rise in tensions at the Ukrainian border. As the dollar is a ‘safe-haven’ currency, it tends to benefit in times of crisis. If the situation between Russia and Ukraine escalates further, this could prompt the dollar to strengthen against a range of currencies.

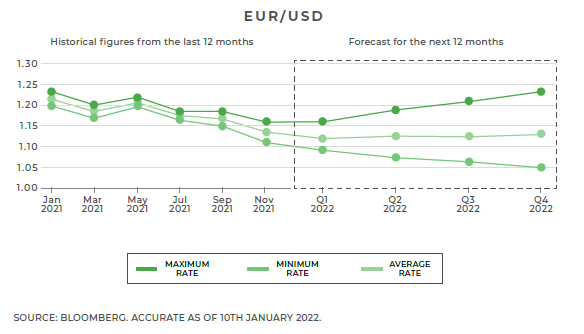

Euro versus dollar

Predictions also show a large disparity for EUR/USD, ranging between 1.09 and 1.16 over the next three months.

Like in the UK and US, the actions of central banks are also likely to affect the euro over the coming months. The European Central Bank has, so far, taken a more ‘dovish’ stance towards monetary policy compared to the Federal Reserve and Bank of England. This means that they are erring on the side of caution when it comes to tapering monetary policy, which isn’t beneficial for the euro.

Tensions at the Ukrainian border could also impact the euro in the coming days and months. The European economy was hit last year by dwindling gas supplies from Russia and the situation with Ukraine could cause further disruption. The economy has shown signs of improvement so far in 2022, however, any setbacks could affect the single currency.