Just as we thought the instability of the last two years may be ending, the war in Ukraine poses further uncertainty. Since the publication of our last Quarterly Forecast, the world is in a very different place – proving that geopolitical events are simply impossible to foresee.

But what does this mean for the currency markets?

Get a quote from us today by completing our simple form. We’ll take a look at your requirements and arrange to speak to you at a suitable time to offer the best possible solution for all of your upcoming currency transfers.

For our readers who will be making a significant transaction overseas in the year ahead and who, therefore, could be paying thousands more or less depending on the strength of sterling, we strongly suggest you do not base any financial decision solely on the predictions from major banks.

However, whilst their predictions may only be educated guesswork, they build into a fascinating guide to the political, economic and health events that will influence the pound and other currencies.

The brand-new Quarterly Forecast is free to download and packed full of analysis and insight from our currency experts here at Smart.

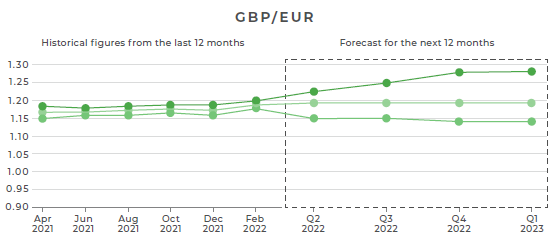

Pound versus euro

According to some analysts, GBP/EUR could fall to around €1.15 in the next three months. Not everyone is quite so pessimistic, though. Predictions stretch as high as €1.23 but settle at an average of €1.19.

Last week, the pound went from strength to strength against the euro, rising above the €1.20 mark. UK inflation, which rose to its highest annual rate in 30 years, supported sterling against a weak euro. This has boosted expectations that the Bank of England will hike the interest rate again at its next meeting and possibly subsequent meetings throughout the year.

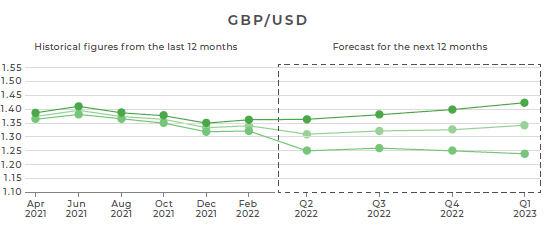

Pound versus dollar

The bank’s predictions show a large disparity for this pairing over the next 12 months, with forecasts ranging from 1.24 to 1.43!

The Federal Reserve (Fed) decided to raise interest rates for the first time since 2018 at its March meeting. Despite the hawkish tone of the meeting, the US dollar weakened following the news as the interest rate hike was largely priced in. However, subsequent hawkish remarks have caused the dollar to strengthen.

Rising US Treasury bond yields, the war in Ukraine and the promise of continuing interest rate rises from the Federal Reserve recently caused the dollar to rise close to its highest rate against the pound in 18 months.

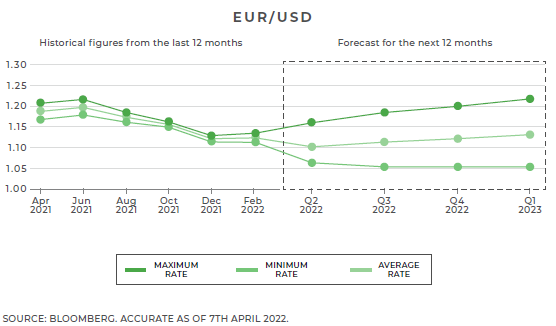

Euro versus dollar

Predictions also show a large disparity for EUR/USD, ranging between 1.10 and 1.16 over the next three months.

The euro recently weakened to its lowest rate against the US dollar in two years. This was due to the ongoing war in Ukraine and its impact on the European economy, the European Central Bank suggesting uncertainty over further interest rate rises and concerns over the French elections. A stronger-than-expected showing for Marine Le Pen’s presidential election campaign has worried the markets, as a win for Le Pen would cause political instability.

Due to regular news coming from the French elections and the war in Ukraine, the euro is likely to continue to be volatile.