When you’re spending a large amount on a property abroad, maybe your life savings, it’s understandable if you look to see if you might get a better rate later on. And plenty of banks, websites and ‘experts’ have an opinion on where exchange rates are heading. However, if your dream property abroad depends on it, there are good reasons NOT to base any major currency decisions on bank forecasts alone.

Bank predictions vs what actually happened

As we’ve seen time and time again, with currency rates fluctuating daily, it is impossible to predict exactly where currencies will be. Despite this, major banks release their predictions each quarter and when these predictions are compared against reality, there are often large disparities between forecasts and reality.

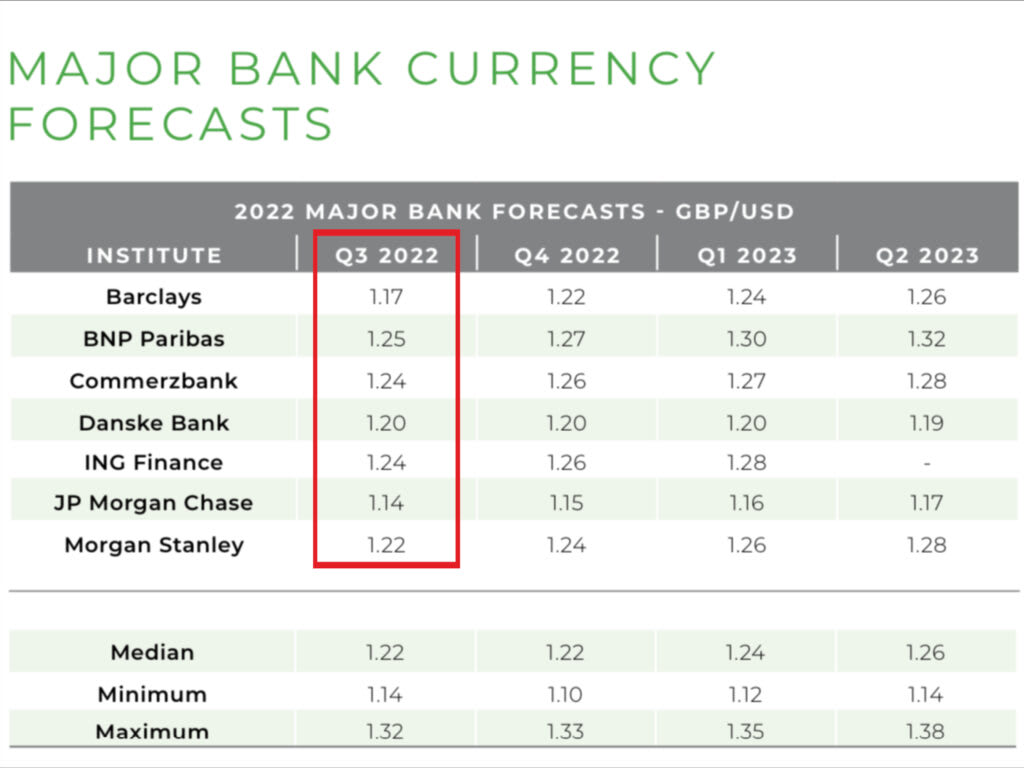

In Smart’s July-September Quarterly Forecast we shared a selection of bank predictions for the third quarter (Q3) and beyond. Below are the GBP/USD rate predictions for Q3 (highlighted in red)

Major bank predictions from our July-September Quarterly Forecast.

JP Morgan Chase predicted the lowest rate for Q3, estimating that the pound would hit $1.14 against the US dollar. While Barclays thought the rate would hit $1.17. In reality, the rate actually fell much lower to $1.09 before plummeting to a 51-year low of $1.03 after Kwasi Kwarteng’s September mini-budget.

The Banks couldn’t have predicted that the mini-budget was going to disrupt the markets as intensely as it did, or that Liz Truss would resign after only 44 days in office causing further volatility. However, this is a great example of why relying on forecasts alone to make major decisions regarding your home abroad is ill-advised.

Another example is the graph below, which shows just how bad sterling was hit after Kwasi Kwarteng’s infamous September mini-budget. The pound recovered in the weeks to follow but the Bank of England’s gloomy economic outlook following its November rate hike caused that recovery to stall.

What does this mean for your home abroad?

Well, there are many factors that play into buying a home abroad, but currency risk is high up on the list. This is because even small fluctuations can have a significant impact on your overall costs and plans to move abroad.

For example, if we take a look at GBP/EUR rates in 2022 so far, the pound has been worth as little as €1.08 and as much as €1.20. This means if you were spending €300,000 on a stunning Spanish home in Costa Blanca, the price would vary by almost £28,000 – and if you’re not prepared for such a significant fluctuation, this could mean saying goodbye to your dream home!

Protecting your money against currency risk

2022 has been a wild and chaotic ride for currencies. We have seen unexpected turbulence and historic lows and we may see similar swings into next year. So, when it comes to making those major decisions, we advise staying well informed and also ensuring you have a good risk management strategy in place.

Not only does our latest Quarterly Forecast compare a selection of major bank forecasts, but our experts provide a clear and easy analysis of what to expect for 2023 and beyond. That way, you’ll have a good estimate of where the pound might by the new year!

Plus discover which upcoming key economic events might trigger currency movements in our economic calendar. Read our latest Quarterly Forecast, for October to December here.

For further information on how Smart Currency Exchange can help protect your budget and international transfers and payments, email us at [email protected], give us a call on +44 (0)20 3918 6985 or get a quote from us.