It’s a busy week and a half for the currency markets as central banks reach a pivotal point in their interest rate policy. That’s why they feature on our brand new Quarterly Forecast for the period up to the end of September. Download your Quarterly Forecast here.

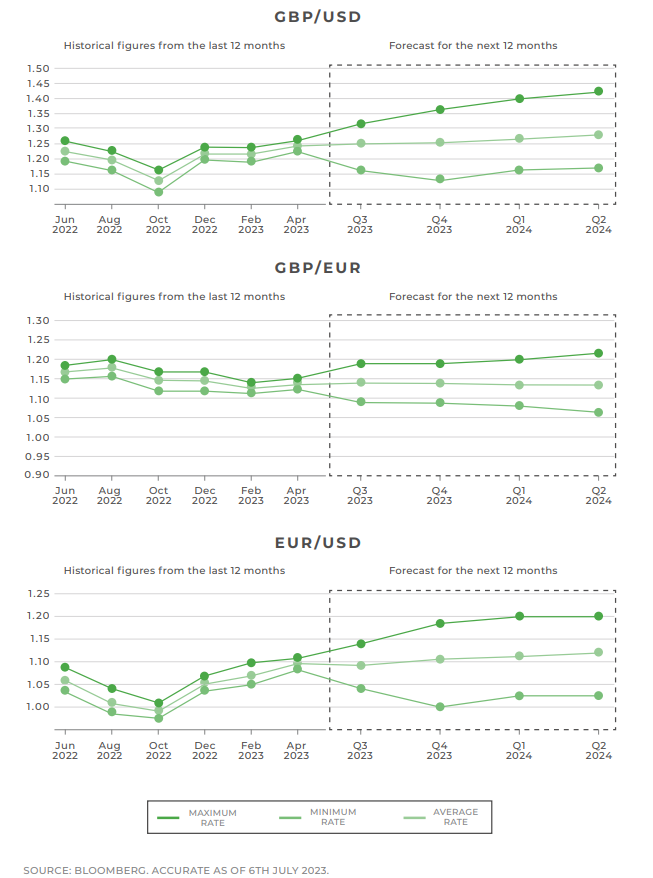

At the start of each quarter leading banks and financial institutions across the world try to predict where the major currency pairings will be three, six and 12 months ahead. While Smart Currency doesn’t offer predictions of its own, in our Quarterly Forecast we do take all the banks’ predictions and create an average of them, along with in-depth analysis of the factors affecting exchange rates.

So what’s happening in currencies?

Inflation and interest rates

The first influence is central banks and their battle against inflation, in which they are armed essentially with one weapon: interest rates.

While usually a country’s currency is supported by good news, and inflation above 2% is certainly not good news, a central bank fights inflation by raising interest rates. The money markets love getting higher interest, so higher interest rates equals a stronger currency. Conversely, the good news of lower inflation earlier this month sent the pound on a downward spiral of seven consecutive days of losses.

Will that continue? Many analysts are banking on UK inflation falling fast, and some have the pound to euro rate dropping as low as €1.09 as a result.

The economy

We’re still very much in the post-Covid era, with economies readjusting to new supply lines and exacerbated by the war in Ukraine sending fuel prices sky high. In the US, President Biden responded with the Inflation Reduction Act, investing hundreds of billions in green technologies to boost investment in America’s homegrown eco-industries and end the reliance on Chinese chips, tech and energy.

The UK has continued to be blighted by poor productivity, whether caused by Brexit, strikes or other factors (GDP was reported to be down in May because of the Coronation).

But it is Germany’s economy that has taken the biggest hit, especially to its manufacturing industries. This week’s PMI data – an accurate gauge of future economic hopes – was at its lowest (outside the immediate pandemic months) since 2009.

Meanwhile, the central banks have been actively trying to curb demand with interest rate rises. Which country can recover economically without inflation will be the long-term winner, and current betting would seem to be on the US dollar.

Politics

Last week’s election in Spain may have shown no clear result, with Spain’s right wing parties failing to win a majority, but the year ahead may see big changes. In Europe, the right appears to be in the ascendancy, winning in Italy and likely to win in Poland, the Netherlands and Slovakia.

The UK may be going the other way, with a general election beckoning, probably by October 2024. In the USA, despite success with the economy, president Biden will face a tough fight next year, probably against Donald Trump. What will that do to global politics and economics?

Currency predictions

These, then are the predictions for the quarters ahead. Read much more in the Quarterly Forecast, free to download here.