It’s no secret that the cost of living in the UK is a hot topic. Prices are soaring generally, but while some categories are seeing slowing price rises, one that shows no signs of stopping is food.

Soaring food prices

In the Office of National Statistics’ consumer inflation measure, food categories dominate the list of items where prices are constantly rising.

When it comes to doing the weekly food shop, the norm, for many, means spending more and buying less.

Those who would normally be unaware of the impact of rising inflation in the UK are startled to see the cost of their everyday items increasing. I’ve personally noticed that every time I pop into my local M&S food, the shop’s own-brand chicken thighs, drumsticks and wings all have increased 10p since my last visit. And the 10ps tot up.

Policymakers are aware about shoppers’ concerns and retailers insist food inflation is a result of poor harvests, sterling weakness and the delayed effect of energy and commodity prices.

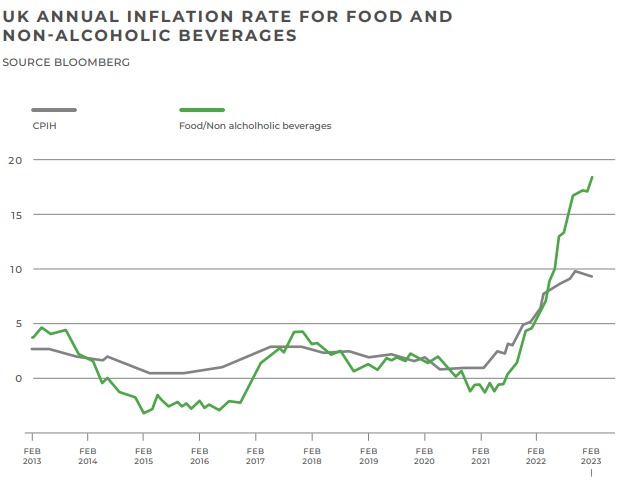

UK food and drink inflation

The UK is still feeling the aftermath of the Covid-19 pandemic, when the government had to find ways to increase spending in order to boost the economy. As we approach the end of April, UK inflation stands at 10.1% – five times more than the Bank of England’s 2% target.

This graph shows Consumer Price Inflation including housing costs (CPIH), alongside the inflation rate for food and non-alcoholic beverages.

Since 2021, the inflation rate of food and non-alcoholic beverages has more than quadrupled in the UK. It reached an annualised inflation rate of 18.2% in February 2023 and 19.2% in March – the highest rates since 1977.

UK vs EU inflation

The overall food inflation rate for the EU matched the UK in March at 19.2% – higher than Portugal, Germany and Hungary which maxed out at a staggering 44.8%.

While many of the world’s economies are also experiencing soaring food inflation, both the EU and the UK had an overall food inflation rate of 19.2%. However, as individual states, France scored 16.9%, Spain 16.5% and Italy 13.2%. This begs the question, would moving overseas be more affordable in the long run?

Is food cheaper overseas?

As prices continue to soar, the prospect of living overseas becomes more appealing to many. If you’re seriously considering a move overseas or buying property outside of the UK, our partner company, Your Overseas Home’s annual Cost of Living index may prove useful.

It’s no secret that the cost of living in the UK is a hot topic. Prices are soaring generally, but while some categories are seeing slowing price rises, one that shows no signs of stopping is food.

Benefits of retiring overseas

The good news for those retiring to European Union countries is that the UK government will uprate pensions just like in the UK. (This is not the case everywhere – the pensions of those retiring to countries like New Zealand and Australia have been fixed). So, on 10th April the state pension was raised by 10.1%, in line with the September-to-September increase in the Consumer Price Index (CPI).

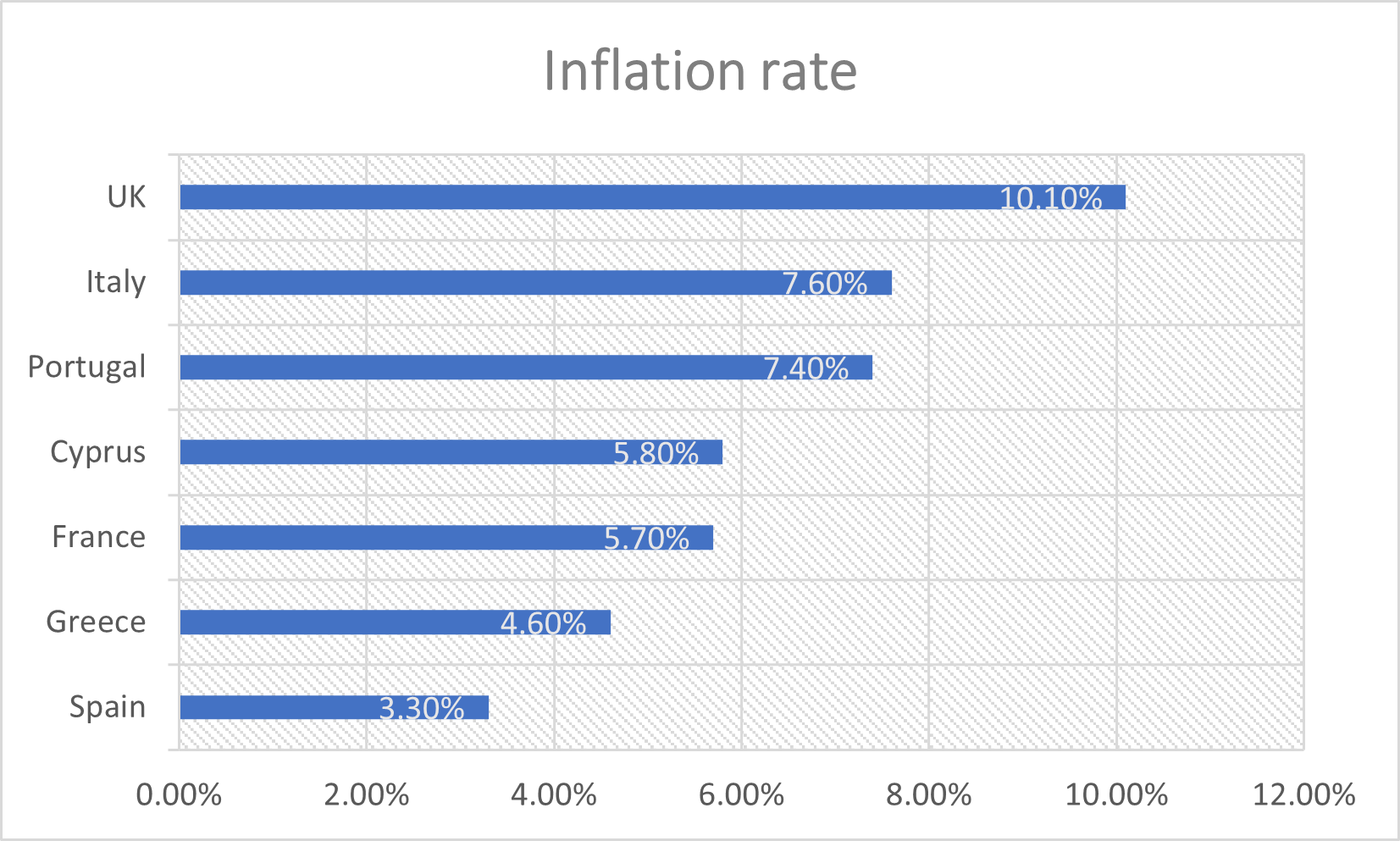

March 2023 inflation rates across the UK and neighbouring countries

However, the latest data shows that inflation in the eurozone is much lower than this. Spain’s inflation is 3.3% (down from 6% last month) and France’s inflation rate is 5.7%. In Italy it’s 7.6% and in Portugal 7.4%. So, the pension increase is considerably above rising prices if you’re moving abroad.

As well as the price of foodstuffs generally being cheaper, they are not rising as fast either, while UK retirees disposable income is rising.

The other benefit of UK inflation rising ahead of that elsewhere is that the UK government is having to continue interest rate rises to beat it. The UK base rate is now 4.25%, so your savings in the UK are earning more, entirely due to inflation. On the other hand, savings are still being eroded by inflation.

For anyone considering a move to an EU-country, Smart Currency is an effective service that can help you manage your currency risk and provide beneficial contracts to lock-in preferred exchange rates. Open a free account with Smart Currency today.